Roosevelt University - Join Roosevelt University's VITA Program! IRS certified volunteers are providing free tax preperation Wednesdays: February 10th through April 7th 1:00 to 5:00 pm on campus, 425 S. Wabash Room WB 116! | Facebook

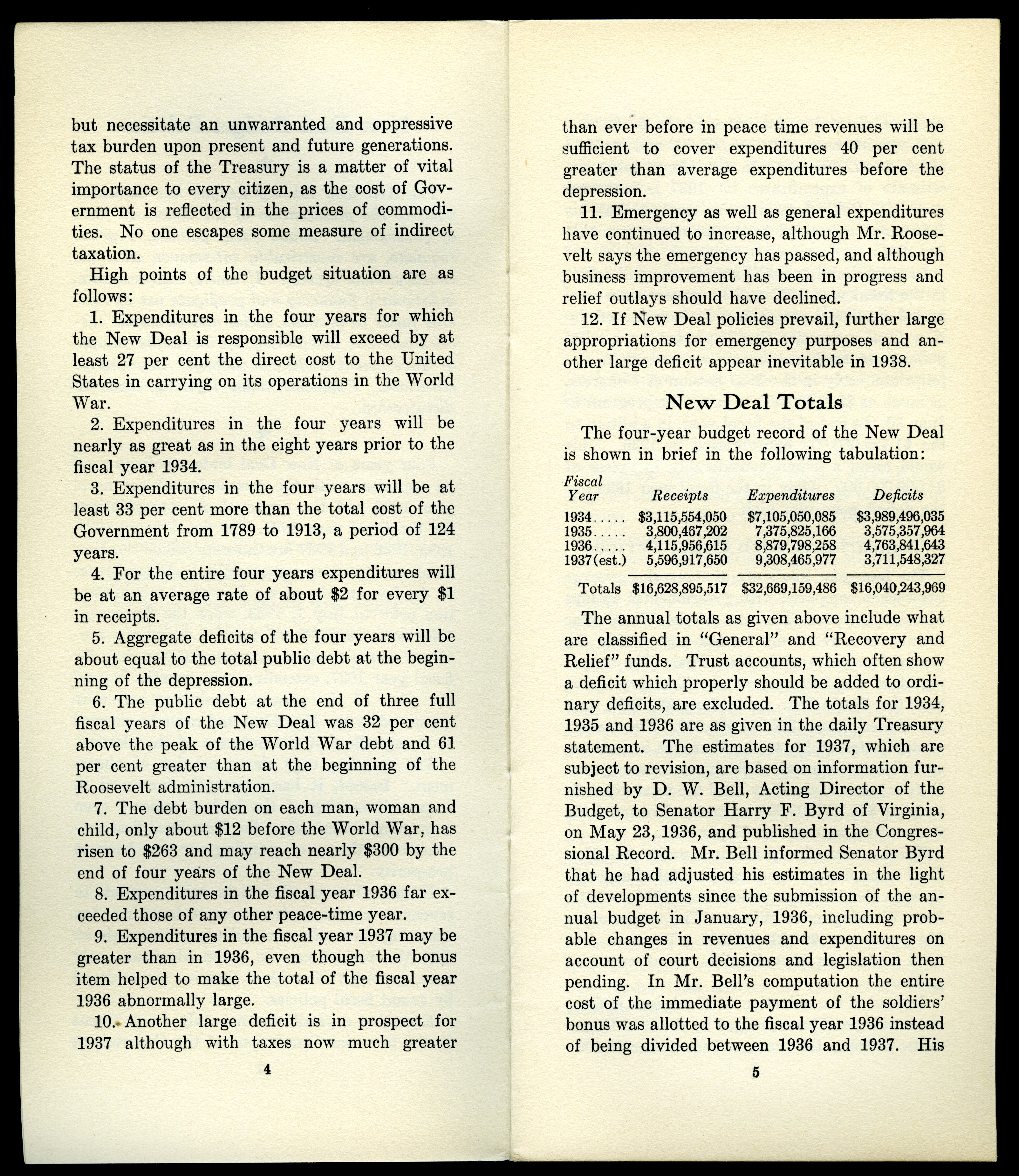

No. 130 "New Deal Budget Policies: A Review of the Huge Expenditures under the Roosevelt Administration and the Alarming Increase in the National Debt…

Franklin D. Roosevelt | Accomplishments, New Deal, Great Depression, World War II, & Death | Britannica

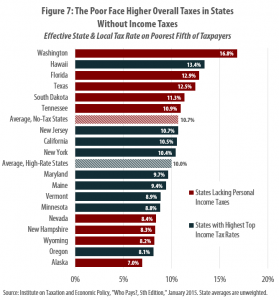

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates – ITEP

:max_bytes(150000):strip_icc()/payrolltax.asp_final-f09aa1c3011c44ba925ae501bd4785ad.jpg)

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)